Powering the Future

2025 Technology Trends Transforming Energy, Utilities, and Resources

The energy, utilities, and resources (EU&R) sector stands at a transformative crossroads as we navigate the complexities of industry challenges. In 2024, the sector witnessed the race to secure critical metals for renewable energy, high-profile consolidations in oil and gas, and the rise of AI-driven solutions in utilities.

As we look towards 2025, the stakes are even higher. Next year will bring unprecedented challenges and opportunities. Are you ready for this energy transition? Accelerate your transformation journey by leveraging advances in technology, including Industrial AI.

Prediction 1

"Global spending on wildfire prevention, mitigation, and response will fall short by over $100B in 2025."

After an intense 2023-2024 fire season, investments in wildfire prevention, mitigation, and response will increase substantially - but will remain an astonishing 100 billion below the target for wildfire prevention.

In 2025, many utilities will invest proactively in wildfire mitigation. For example, Pacific Gas & Electric plans to invest approximately USD 18 billion, while Southern California Edison will spend about USD 5.8 billion. Yet even these substantial budgets fall short, with an investment gap anticipated of approximately USD 100 billion.

Offsetting budget gap with environmental technology

Many EU&R companies will rely on technology to bridge the gap, from existing systems such as enterprise asset management (EAM) to ensure equipment is running and maintained optimally, to innovative advances that leverage operational data, automation, and remote monitoring.

Prediction 2

"Data-driven decisions transform asset optimization: Investments in asset optimization technology will increase by 15% to support data-based decision-making."

Many EU&R companies struggle to justify business case rationale when proposing new capital investment projects. With little data to put behind these decisions, gaining the support of investors and regulators is difficult at best.

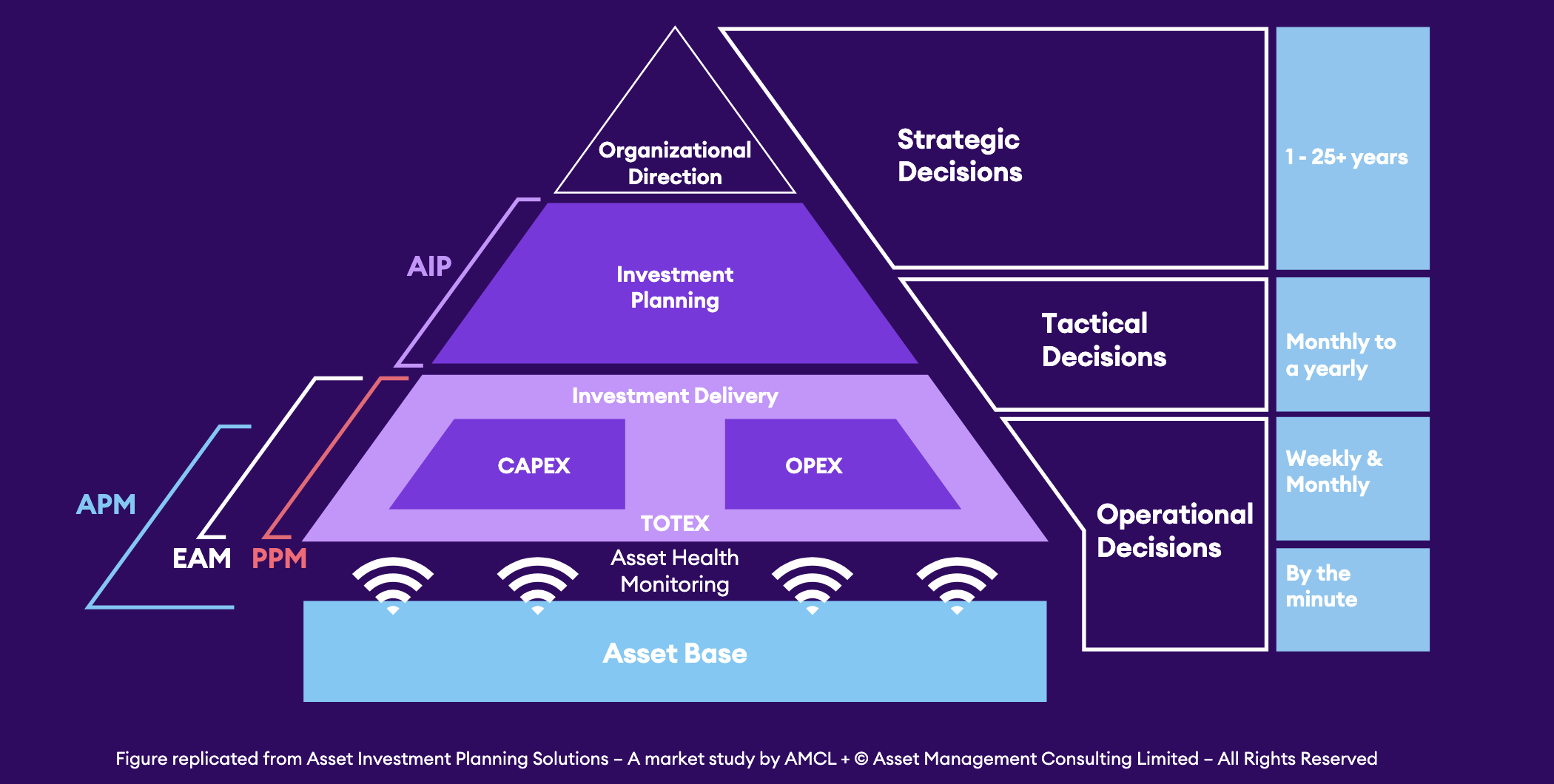

Some EU&R organizations leverage end-to-end asset lifecycle management, including Industrial AI, asset investment planning, predictive maintenance, and other technologies to better inform business decisions and investments.

Full-cycle lifecycle management

An effective asset lifecycle management solution involves data that supports operational, tactical, and strategic decisions.

Prediction 3

"The adoption of virtual power plants will increase over 20% by 2030."

As the worldwide grid becomes more decentralized, EU&R companies are implementing virtual power plants (VPP) at an astounding rate. Market demand is estimated to reach USD 6.2 billion by 2028 with a CAGR of 21.5%.

"Virtual power plants have the potential to change the energy horizon by harnessing the electricity from local assets and redistributing that power to where it is most needed-all facilitated by cloud-based software that has a full panoramic view."

Critical Drivers for Global VPP Market Increase

By leveraging VPPs, EU&R companies aggregate or consolidate the increasing number of "prosumer" renewables connecting to the primary power grid. These connections are integrated into the larger control center, making it easier to manage the high volume of small interconnections while gaining important insights into the volume and frequency of the energy produced.

- • Renewable energy use in power generation

- • Investments in adopting smart grids

- • Global demand for electricity

Summary

"As we head into 2025, many unknowns await including the geopolitical landscape and the progression of climate change. By leveraging advances in technology - including Industrial AI – and investing in infrastructure, EU&R companies benefit from a flexible and agile business model to help weather the opportunities and challenges that lie ahead."

Book My FREE IFS Strategy Session